Hi, My new Homey Pro is with UPS awaiting delivery but I’m being asked to pay import duty ~ £72. Is this normal and if so should it not be made clear when ordering?

Brexit ![]()

Well, that’s normal.

It like the same as if you ordered it from the US or somewhere else. Import taxes are normal.

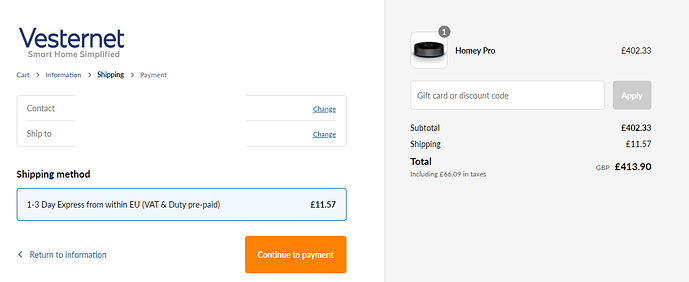

I’ve never had this before, surely Athom should have flagged this up at the time of purchase. Also UK retailers are offering the pro at the same price locally (Vesternet - although they are waiting on stock)

I’ve seen a message on the forum (not confirmed by an Athom employee) that Athom will refund the import costs as it should have been taken into account, at least towards the UK.

So you should contact Athom to verify this, and please also give back the confirmation here of course.

Only the VAT should be taken into account (i.e. Athom should sell the device to UK customers without VAT applied), import costs/duties are really a Brexit tax.

Thanks for all your reply’s

I’ve received confirmation from Athom that they cover these costs. I have now paid Ups and awaiting a refund from the Athom team

Would just suggest that this information is provided at the time of placing the order

Just waiting now for UPS to attempt a second delivery. They tried earlier and had the box in their hands but could it hand it over as their payment system was down ![]()

Thanks again for your help and comments

Yeah it’s a bit odd the VAT is (still) included for the UK.

For f.i. shipment to Norway, the price is already without Dutch VAT.

Today: €297

Athom hasn’t taken the VAT off for neither of my 3 Homey’s bought in 2017, 2020 and 2022. When I asked them why not, they went silent. Any other company from EU that I buy from, does.

Yeah, got ripped off 3 times. At least I didn’t have to pay local customs.

BTY, I live Down Under and not UK

I have always had VAT charged by Athom and again on import. I always assumed the Webstore advertised price excluded VAT as it doesn’t state. I’ll contact Athom directly.

VAT can only be left out for intra-community purchases; i.e. from company to company.

Prices excluded VAT are even not allowed by EU-rules and regulations. All costs and taxes should always be included unless the (online) store is aimed solely and exclusively at business customers and clearly communicates that. VAT or sales tax is required to be charged on all transactions.

Nothing to do with athom. They could of course decide to refund a part of the puchase amount, but they themselves would still have to pay the taxes due. Again, unless if you are a business customer.

Then explain me why Vesternet and others I’ve bought from dropped the VAT at checkout.

Don’t know. What I can see on their website are prices. Probably VAT incl.?

But maybe you are just asking the wrong person?

Ah, I see now. They are a UK based company.

There is your explanation. You are probably a non-UK citizen?

Did you pay EU-import duties?

No, they don’t. For shipping goods outside the EU (which now includes the UK) there’s a 0% VAT tariff.

Without VAT and with import duties included, the article is 3,33GBP more expensive than the same product for a UK customer.

![]()

No mate, I live Down Under as stated above.

No VAT should apply.